2017 has come and gone, with no notable London Market bar date in sight! In contrast, 10 years ago KCIC was tracking 10 different schemes, including some schemes for solvent insurance companies. The numerous insurance company insolvencies in the 80s and 90s led to many schemes of arrangement and bar dates requiring policyholders to act to preserve coverage. Most of these forced policyholders to commute all past, present and future claims against one or more insurance companies, sometimes including solvent ones. Missing just one of these deadlines could be disastrous in terms of lost coverage. In particular, the popularity of solvent schemes of arrangement by insurance pools with complicated terms kept us on our toes. We even created a “Schemes and Insolvencies” database for our Ligado Platform to help keep deadlines straight and share this wealth of information.

Now we must ask, with so little scheme activity in the past few years, where have all the bar dates gone?

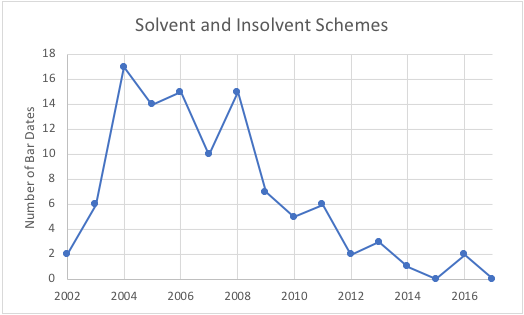

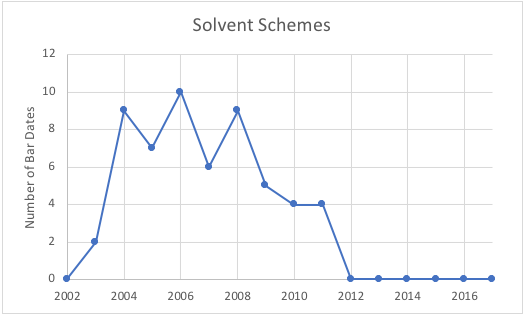

Since our founding in 2002, KCIC has been tracking scheme activity and bar dates through a variety of sources. The perceived decline in the use of crystallization schemes of arrangement (a fancy term for schemes that include a final claims bar date) is borne out by the data we’ve collected:

While we certainly don’t have every scheme and bar date in our database, we can attest to the fact that scheme-related activity at KCIC has been minimal over the past three to five years, with the notable exception of the Orion and London & Overseas bar dates in September 2016.

So why the decline? For starters, it appears most of the companies that went insolvent in the 80s and 90s have already implemented bar dates. Gone are Andrew Weir, Orion, English & American, North Atlantic, Sovereign Marine & General, the KWELM Companies, and many others that underwrote big books of business with U.S. companies in the 1950s through 1980s. As a consequence, policyholders who are just now tapping their old London Market coverage may find themselves with significantly less-valuable policies.

What then, has happened to the solvent schemes? We at KCIC have generally looked at solvent schemes unfavorably, particularly when it appears they mainly benefit the owners of the insurance companies. Often controversial, many such solvent schemes faced organized opposition from U.S. policyholders who objected to being forced to take back risks they had purchased insurance to cover, which in turn increased the administrative costs for companies pursuing schemes. The British Aviation and Scottish Lion decisions further increased the cost in time and money required for an insurance company to propose and implement a solvent scheme of arrangement.

Regulatory changes seem to have created uncertainty as to how various agencies would monitor schemes. The creation of the Prudential Regulatory Authority (“PRA”) and the Financial Conduct Authority (“FCA”) under the Financial Services Act of 2012 raised the question of which regulatory body would handle schemes of arrangement. The PRA’s 2014 supervisory statement set ostensibly high standards for which solvent schemes would be considered acceptable, but also made it clear that both the FCA and PRA need to be involved at an early stage in the scheme process.

Run-off managers’ desires to achieve finality haven’t diminished, as the adoption of Solvency II capital requirements has put pressure on companies to either increase reserves for run-off portfolios, or dispose of them. Whereas schemes may have been the preferred vehicle 10 years ago, other options are more popular today.

Companies still wishing to be rid of their legacy business have benefited from the rise of large run-off specialists like Enstar, Catalina and Berkshire Hathaway (to name just a few). These companies have purchased, reinsured or accepted transfer (via a Part VII mechanism) of many run-off companies or books of business over the past five or so years, mirroring the consolidation of legacy liabilities in the U.S. market. In fact, over the next couple of years, more than 30% of the respondents to PWC’s tenth edition of its “Survey for Discontinued Insurance Business” wrote that they expect more than 20 disposals – many for portfolios valued at over €100m. This 2016 study also found that 77% of run-off managers are considering restructuring or achieving finality for their books of business in the next three years, so we can expect these trends to continue.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas