Recently we launched a series here on “Risky Business” about the myriad tasks and issues that arise when childhood sexual abuse claims are filed, and the steps you can take to be ready if and when survivors file against your organization. You can read the first installment here. In this installment, we focus on insurance archaeology, which may be necessary when coverage cannot be located.

Ongoing allegations of child sexual abuse, coupled with the increase of claim windows in states such as New York and Maryland, highlight the importance of having decades of insurance policy information readily available. Insurance is a common asset used to compensate survivors, and while financial compensation cannot entirely erase the terrible toll on victims, it is a valuable part of the healing process. Insurance can also assist with developing a robust investigation for claims.

As claim windows begin to open in more states, it is advisable for organizations that expect an influx of claims to proactively begin locating and leveraging insurance policies. These organizations should be sure to locate, organize, and save documents electronically; review and code key provisions in a database; and retain coverage counsel with relevant experience. If coverage is not easily found, there are steps to be taken to locate it; this is known as insurance “archaeology”.

Locating decades-old insurance coverage, however, may not be an easy task. It requires resources that many organizations do not have, the biggest simply being time. Many hours must be invested to thoroughly understand when, and how, coverage was purchased and to search through records to locate the policies — or more commonly, secondary evidence of them. Insurance policies can be difficult to find due to several reasons, including personnel shortages, a lack of electronic copies of documents, document retention guidelines, loss of institutional knowledge, or just the passage of time.

It is important to know where to look for and find potentially applicable coverage. Historical business records, such as board minutes and records of financial transactions, could indicate carriers who provided coverage to the institution. It is also possible that certificates of insurance were filed with lenders or, in some cases, government agencies. Once potential carriers are identified, the carriers can perform a search of their own records to see what information is available.

Simply identifying possible available coverage is not the only step. Policyholders need to know what is covered by the policy language of these historical policies. Analyzing the language allows the policyholder to identify the specific institution naming that is covered by the policy and whether there are additional named insureds. Policies may contain language specifying terms such as a “consent to settle” clause or definitions clarifying what the policy will cover, such as what constitutes a bodily injury claim or the definition of an occurrence. For long-standing institutions, it is important to have the most up-to-date versions of a policy accessible. Additional forms, known as endorsements, may be attached to existing policies to amend coverage availability. These additional stipulations may contain exclusionary language that removes carrier liability for certain injuries, such as sexual abuse and molestation, or specifies additional steps that the policyholder is required to take to obtain coverage, such as background checks. Sometimes, a policy includes a declaration page with a table of contents for the endorsements associated with that policy, making it easier to identify each endorsement.

KCIC can help identify and monetize insurance assets. When there are potentially hundreds of policies to assemble and hundreds, if not thousands, of pieces of language to analyze, it becomes challenging to figure out how the pieces fit together and what it means to the insured (aka the policyholder). Some ways in which we can facilitate the process include the location of coverage, correspondence with carriers, and record-keeping of policies.

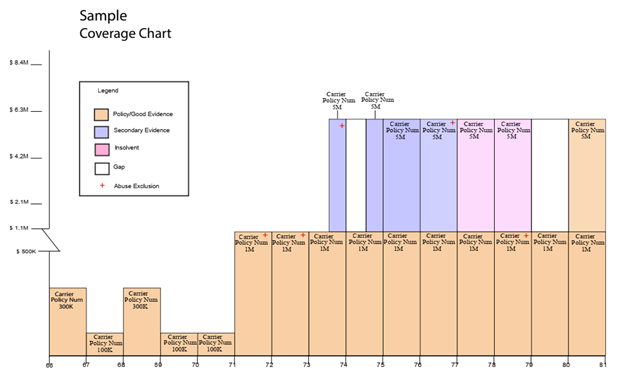

Providing coverage visualizations, such as the coverage chart below, may help defendants understand their coverage. Coverage charts identify the policies available to the named insured and are customizable to show information that may be of interest to the client.

KCIC understands the significant strain such tasks may put on many defendant organizations, and we are ready and able to assist.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.