Two years ago, I wrote a blog titled 21st Century Insurance Policy Review: Part 1 describing process and technological advances KCIC had made in analyzing and capturing key terms and conditions from hundreds of insurance policies. I also opined on what the future may hold (AI-assisted policy review and analysis) and promised to report back. While we are not ready to launch a policy review bot, we have been busy innovating our policy review process.

Looking Back

When I joined in 2004, some of the first projects I worked on at KCIC were policy reviews. Back then, such projects could feel interminable. Consultants struggled with the grind of inputting long paragraphs into our databases manually. The quality control process was equally grueling, requiring relentless attention to minute detail and the patience to print and check off pages upon pages of language and provisions. Each set of changes required a new stack of documents to be printed to maintain the paper trail. Often, several coders and reviewers would put up shop in a conference room for months. This allowed for constant communication but made it difficult to serve other clients or to leverage larger monitors and multiple displays.

Ensuring consistency across policies and coders was also challenging. The dual requirements of understanding insurance policies and having the patience necessary to code and analyze them made for a steep learning curve, which in turn meant a general shortage of personnel able to execute a policy review.

In the Summer of 2018, we were approached with an opportunity to undertake what would be our largest policy review by a long shot. While KCIC had continuously improved our policy review processes over those 14 years, it quickly became apparent that we needed to rethink everything on how we do our policy reviews in order to tackle such a large project. We would need to enhance our language-capturing methodology, how we capture policy data and ensure its accuracy, our process for evaluating coding consistency across people and policies, and even how we train new consultants for policy review. Necessity being the mother of all invention, we began to tirelessly retool every part of our policy review process to uncover greater efficiencies.

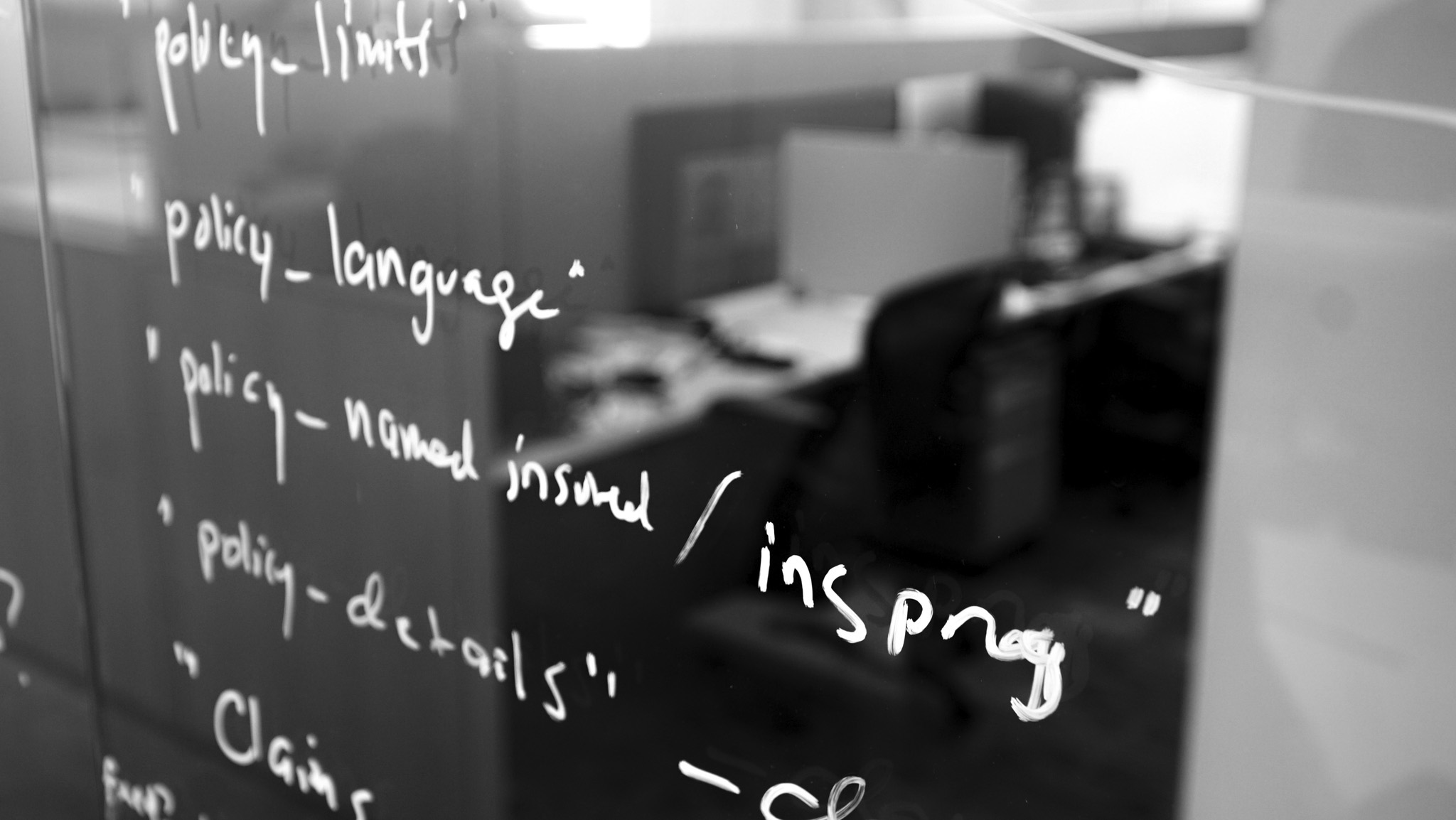

Coding Process Advancements

Electronic database reports have thankfully replaced the stacks of manila folders on my shelf. Our cloud-based network allows coders and reviewers to make notes on these reports and instantly save them on the network, eliminating version control concerns. Some of our best improvements have been the easiest to make, such as updating these reports to mimic how reviewers naturally quality control policies and instituting cross-checks to mitigate against basic coding errors.

Our past experiences have taught us that some of policies we reviewed are likely to have identical standard language forms, especially on an insurer-by-insurer basis. Why should we code each of these forms in a vacuum? Instead, my colleagues Victor Taylor and Kathrin Hashemi designed a process for importing language from one policy to another, with full transparency of where the language first came from so the reviewer can verify it was appropriate to copy. Identifying these policies at the beginning of the review allows us to target “new” policies, finalize them, and then quickly roll out the correct language to any other policy with the same form.

Consistency is Key

The “copy policy” process I described helps tremendously to ensure that policies that look the same are coded the same, but with a team as large as 12 people and almost 10,000 records of language in our database, we needed to take additional steps to deliver accurate and consistent work product. We worked with our technology team to develop a dashboard of policy language and provisions coded for all policies in the database. The dashboard is built in Microsoft’s Power BI platform and allows quick and easy filtering to compare whether policies with similar language are coded in similar ways. We also built out a data validation app that we use to check for common OCR issues invisible to the naked eye, inconsistencies across policies, and other data issues.

Training and Onboarding

We wouldn’t be able to tackle such a large project using only a few other experienced policy reviewers and myself– we needed a large team and a way to train them quickly. Additionally, we needed faster and better ways to communicate while allowing people to take advantage of the benefits of their command stations (three screens are better than one). Piling into a conference room removes this advantage and does nothing to bolster communication with employees working remotely, so we decided to use Microsoft Teams. After some setup, Teams became the perfect place to document project background, training materials, communicate key decisions, and easily share information and documents. Whenever someone new joins the project, they are added to the group on Teams to receive immediate access to standard operating processes, useful database queries, pre-recorded training videos, FAQs, and key decisions. New questions and decisions get posted as conversations for all to see, and team members can be tagged to bring matters specifically to their attention. Onboarding new team members takes drastically less time now.

Game-Changing Support

I’ve worked on policy reviews on and off for 15 years so I can confidently say that the improvements we’ve made over the past year have been transformational for our team and our clients. We have reviewed and coded more policies over the past year than I would have thought possible. I’m excited to put these procedures and technologies in service of more clients going forward. Oh, and we’re still exploring AI technology to expedite reviews even more – stay tuned!

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas